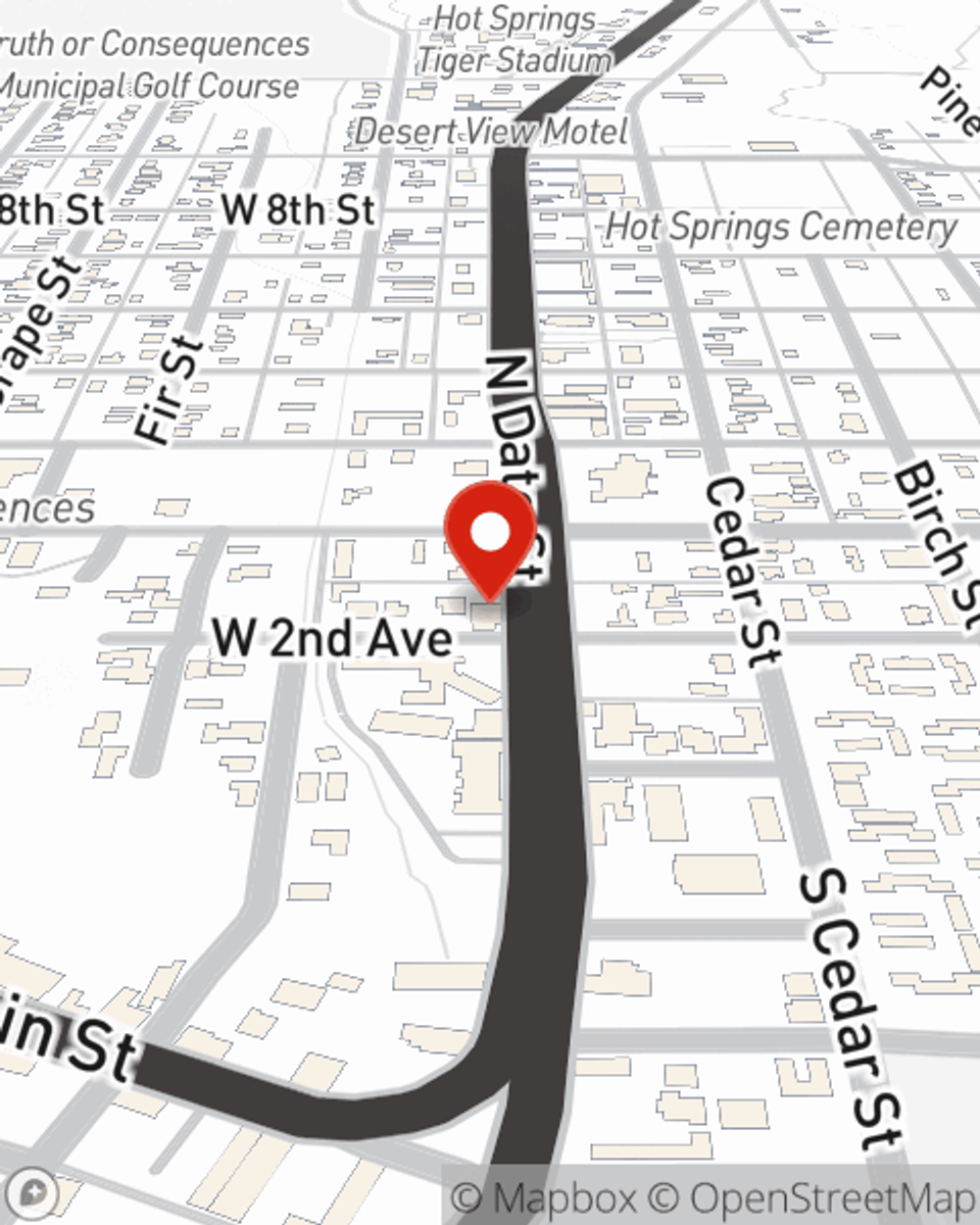

Life Insurance in and around Truth or Consequences

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Can you guess the price of a typical funeral? Most people aren't aware that the typical cost of a funeral today is $8,500. That’s a heavy burden to carry when they are grieving a loss. If your loved ones cannot cover those costs, they may fall on hard times in the wake of your passing. With a life insurance policy from State Farm, your family can survive, even without your income. Whether it pays off debts, keeps paying for your home or maintains a current standard of living, the life insurance you choose can be there when it’s needed most by your loved ones.

Protection for those you care about

What are you waiting for?

Wondering If You're Too Young For Life Insurance?

And State Farm Agent Mike Potia is ready to help design a policy to meet you specific needs, whether you want coverage for a specific number of years or coverage for a specific time frame. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Interested in checking out what State Farm can do for you? Contact agent Mike Potia today to get to know your individual Life insurance options.

Have More Questions About Life Insurance?

Call Mike at (575) 894-2528 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Simple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.